Embrace The Future

Malaysia E-Invoicing

Overview of Malaysia E-Invoicing

What is E-Invoicing?

E-Invoicing, or electronic invoicing, marks a significant leap from traditional paper-based invoicing to a digital format. It is a method where invoices are created, sent, and received in an electronic format, allowing seamless data exchange between the supplier's and buyer's financial systems. This digital transformation eliminates the need for physical invoices, fostering a more efficient, accurate, and eco-friendly billing process.

Why the Shift from Traditional to Digital Invoicing?

In contrast, e-invoicing enhances transactional transparency and enables businesses to manage their finances better. With the push towards digitalization, governments and businesses worldwide are adopting e-invoicing to streamline taxation processes, reduce operational costs, and promote sustainable business practices. In Malaysia, this shift is supported by the government's implementation of the MyINVOIS system, which facilitates the easy submission and management of e-invoices, ensuring compliance and quicker processing times.

Benefits of E-Invoicing

E-invoicing not only streamlines the billing process but also brings a multitude of benefits that can transform your business operations. Here are the key advantages:

Faster Processing and Payment

E-invoices facilitate real-time invoicing and faster processing, which accelerates payment cycles and improves cash flow. With digital transactions, invoices are delivered instantly and can be processed more quickly than traditional paper invoices.

Cost Reduction

Improved Compliance and Accuracy

E-invoicing reduces the risk of human error and ensures greater accuracy in financial transactions. It simplifies compliance with tax regulations and standards, as digital records are easier to maintain, audit, and submit to tax authorities like LHDN.

Easy Access and Better Organization

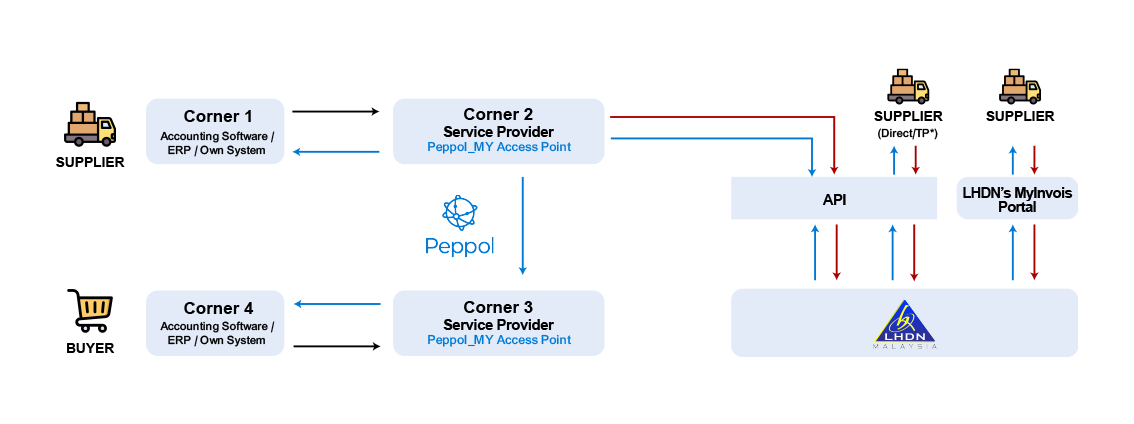

Supplier and Buyer:

These are the two primary parties involved in a transaction. Suppliers provide goods or services, and buyers purchase them. In the context of e-invoicing, both suppliers and buyers need to adapt their systems to handle electronic invoices.

Corner 1 & Corner 4 (Accounting Software / ERP / Own System):

These corners represent the IT systems used by both suppliers (Corner 1) and buyers (Corner 4) to create, send, receive, and manage invoices. The terms 'Accounting Software' and 'ERP' suggest that businesses may use off-the-shelf financial software, customized enterprise resource planning systems, or their own internally developed systems.

Peppol Network:

Peppol is a framework that enables electronic business document exchanges (like invoices) across borders and industries. By referencing "Peppol_MY Access Point," the model suggests that Malaysia has established or is establishing a national access point connected to the global Peppol network, making it possible for Malaysian businesses to engage in both domestic and international e-invoicing.

Corner 2 & Corner 3 (Service Provider - Peppol_MY Access Point):

These corners act as intermediaries between the businesses and the Peppol network. They are essentially service providers that help businesses connect to the Peppol network to send and receive e-invoices.

API:

The API functions as the interface that connects the service providers with LHDN's MyInvois Portal. It allows for the electronic exchange of invoice data, ensuring that the data transmitted between systems is consistent and secure.

LHDN’s MyInvois Portal:

This is the government's portal, likely managed by the Inland Revenue Board of Malaysia (LHDN), for processing and validating e-invoices. It serves as a centralized system for ensuring that the invoices are compliant with Malaysian tax regulations, and it could also facilitate tax reporting and auditing processes.

This e-invoicing model is designed to support compliance with Malaysian tax laws, reduce paperwork, and promote efficiency in business transactions by automating and standardizing the invoicing process. It allows for the seamless electronic exchange of invoice information, which can lead to faster payments, reduced processing errors, and improved financial management for both suppliers and buyers.

Standard E-Invoice:

This is the most common type of e-invoice and is used for straightforward, single transaction billing between a supplier and a buyer. Standard e-invoices are generated using accounting software such as AutoCount Accounting or Cloud Accounting, and can be easily uploaded to platforms like the AutoCount E-Invoice Platform (AIP) for submission to the LHDN MyINVOIS system.

Self-Billed E-Invoice:

For businesses that handle complex transactions, such as international procurement or commission payments, self-billed e-invoices offer a way to automate the invoicing process. This type of e-invoice allows the buyer to issue the invoice to themselves on behalf of the supplier, which is particularly useful in scenarios where the buyer has more control over the terms of purchase. AutoCount's e-invoice solution facilitates the transfer of details from purchase invoices and payment vouchers to create self-billed e-invoices, reducing the need for manual data entry and increasing efficiency.

Consolidated E-Invoice:

Ideal for businesses with high-volume transactions, such as retail and F&B businesses, the consolidated e-invoice allows for multiple transactions to be combined into a single invoice. This is particularly useful for business owners managing multiple outlets, as it simplifies the billing process by consolidating invoices from each location, ensuring they meet LHDN regulations. Customers can also interact with the system via QR codes on receipts to initiate and receive consolidated e-invoices.

By choosing the appropriate type of e-invoice, businesses can enhance their billing processes, improve accuracy, and ensure compliance with Malaysian tax laws.

Types of E-Invoices

E-invoicing offers flexibility through different types of electronic invoices, each designed to cater to specific business needs. Understanding these types can help you select the most suitable e-invoicing solution for your operations. Here are the three main types of e-invoices you can use:

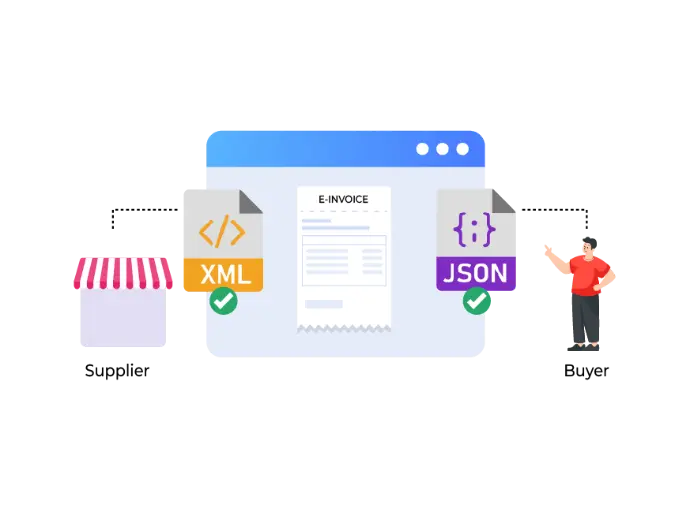

Formats and Standards

Standardized formats ensure smooth data exchange between different accounting and billing systems. The most common formats are:

JSON (JavaScript Object Notation):

A lightweight, easy-to-read format that enables fast data exchange and integration with web technologies.

XML (EXtensible Markup Language)

Using these formats helps businesses streamline e-invoicing and improve system compatibility.

Importance of Standards for Interoperability

Standards ensure that e-invoices from one system can be correctly received and processed by another, preventing data errors. They:

Using standardized formats like JSON and XML enhances compatibility and streamlines e-invoicing across digital systems.

Implementation Timeline

The rollout of e-invoicing in Malaysia is structured to accommodate businesses of various sizes by specifying implementation dates based on annual turnover. This phased approach ensures that all businesses have ample time to prepare and transition smoothly. Below is the implementation timeline:

1 July 2025

Category

All taxpayers

This timeline is critical for businesses to ensure compliance and leverage the benefits of e-invoicing effectively.

Targeted Taxpayers

The introduction of e-invoicing in Malaysia is part of a broader initiative to enhance the efficiency of tax collection and compliance. It targets a wide range of taxpayers, ensuring comprehensive coverage across various sectors and business structures. Here’s a detailed list of entities required to comply with e-invoicing requirements:

Call to Action

Take advantage of our e-invoicing solutions today and streamline your business transactions. Sign up now and receive:

Free Consultation: Get expert advice on transitioning to e-invoicing tailored to your business needs.

Get in Touch

For more information or to schedule your free consultation, contact us:

Email: [email protected]

PeppolSync Assistance: If you need help with Peppol integration or direct system integrations, our team is ready to assist you in ensuring seamless e-invoice translation and compliance.