Odoo Accounting Solutions with Full LHDN Compliance

Features of Accounting

Precomp specializes in delivering Odoo accounting solutions tailored for Malaysian businesses, ensuring compliance with the latest regulations set by LHDN (Lembaga Hasil Dalam Negeri Malaysia). Whether it's for e-invoicing or managing Payroll PCB (Potongan Cukai Berjadual), Precomp’s solutions offer a seamless, efficient, and compliant financial system that helps businesses remain ahead of regulatory requirements.

1. LHDN E-Invoicing Compliance Made Easy

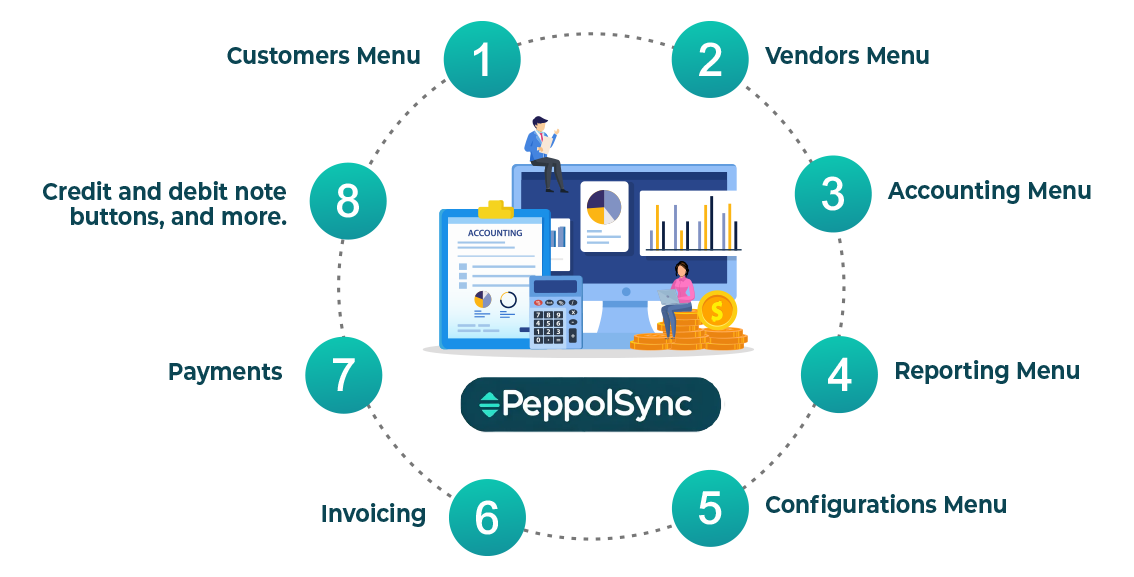

Seamless Integration with Peppol:

Precomp’s Odoo solution integrates with the PeppolSync Engine, allowing your business to automatically convert any type of invoice (PDF, Word, Excel, scanned images, etc.) into a compliant e-invoice format. This ensures that every invoice meets LHDN standards before submission to the Peppol network.

Automated Invoice Validation:

Precomp’s PeppolSync Engine validates invoices automatically with LHDN’s compliance framework, ensuring no delays or rejections. This automation significantly reduces human errors and streamlines the entire process of e-invoicing.

Real-Time E-Invoice Submission:

With Odoo integrated by Precomp, businesses can submit e-invoices to the LHDN network in real-time, ensuring timely processing and reducing the burden of manual tax submissions. The system is updated regularly to keep pace with changing e-invoice regulations, so you never have to worry about non-compliance.

Comprehensive Reporting & Tracking:

Precomp helps you utilize Odoo’s robust reporting features to track and audit all submitted e-invoices, making it easier to manage tax audits, monitor transactions, and stay on top of your financial data.

2. Payroll PCB (Potongan Cukai Berjadual) Compliance

Accurate and Automated PCB Calculations:

Precomp’s Odoo configuration ensures your payroll system automatically calculates PCB based on the latest tax brackets and guidelines set by LHDN. This eliminates the need for manual calculations and ensures the correct amount of tax is deducted from employee salaries.

Form Generation and e-Submission:

With Precomp’s Odoo setup, businesses can automatically generate essential tax forms such as EA Forms, CP39, and other required documents for PCB submission to LHDN. Odoo is also integrated with LHDN’s e-Filing system, allowing for the electronic submission of these forms, simplifying the entire process.

Custom Payroll Reports:

Odoo allows you to generate payroll reports tailored to your business needs, ensuring full visibility over all PCB deductions and LHDN submissions. These reports are audit-ready, ensuring that businesses can confidently present accurate data to LHDN during audits.

Automated Year-End Tax Filing:

3. End-to-End LHDN Compliance for Malaysian Businesses

Always Up-to-Date:

Precomp keeps your Odoo system updated with the latest changes in Malaysian tax laws, especially regarding e-invoicing and PCB. Our team ensures that all tax calculations, submissions, and reports adhere to the latest LHDN standards, so your business is always compliant.

Audit-Ready Financial Records:

Odoo allows you to maintain clean, organized, and compliant financial records that are easily accessible for audits. Precomp ensures that your Odoo system is configured to produce detailed reports, which makes tax audits a smooth and stress-free process.

Why Choose Precomp for Your Odoo

Accounting and Compliance Needs?

you get a partner dedicated to ensuring your financial processes are optimized for compliance and efficiency.

Tailored Solutions:

We understand the unique needs of Malaysian businesses and offer solutions that are customized to fit your operations, whether you are a small business or a large enterprise.

Local Expertise:

Our in-depth knowledge of LHDN regulations and Malaysian business practices allows us to ensure that your Odoo system meets all local compliance requirements for both e-invoicing and payroll.

Ongoing Support and Training:

At Precomp, we don’t just implement Odoo—we train your team to use it efficiently. Our ongoing support ensures that your business continues to operate smoothly, with help always available when you need it.

Affordable and Scalable:

Get Started with Precomp’s Odoo Accounting Solution Today

Whether you need help transitioning to LHDN-compliant e-invoicing, or managing accurate Payroll PCB calculations, Precomp is here to help. Our Odoo accounting solutions ensure that your business stays compliant with LHDN, while also streamlining your financial processes for maximum efficiency.

Contact us today to learn more about how Precomp can support your business with Odoo accounting software, tailored to meet the unique demands of Malaysian businesses.